值得信赖的区块链资讯!

值得信赖的区块链资讯!

Decentralized Exchanges (DEXs)

Decentralized exchanges are crypto exchange platforms that are open source, have no central governance and enable peer-to-peer trading, or as the name itself suggests are decentralized. DEXs ensure that a user information, such as transaction details and personal data, is safely and securely stored with a guaranteed customer anonymity.

Types

Broadly speaking, there are two types of decentralized exchanges, currency centric and currency neutral. Currency centric is more of a traditional model developed on top of an existing blockchain platform, which allows the exchange of only those currencies that are built on that very blockchain platform. Conversely, the newer model, a currency-neutral exchange enables connection between a diverse group of crypto assets that are developed on the different blockchains. This type of an exchange is constructed using a smart contract technology – Atomic Swap. This technology allows for an exchange between cryptocurrencies without a need for centralized intermediaries. Atomic swap usually happens between the blockchains of different crypto assets; however, it is possible this procedure to occur off-chain.

Benefits

An absence of central authority and established a peer to peer network are the main perks of decentralized exchanges. These features eliminate the need for a third party authenticator and the users can directly interact with each other. Further, decentralization can also result in faster and cheaper transactions if the network effect of the exchange platform increases in the long run.

Decentralized nature of DEX leads to another more significant attribute — censorship resistance. Censorship resistance ensures that no governing power can inflict restrictions and regulations on the exchange users or prohibit someone from using cryptocurrency of choice. This is a very significant aspect of DEX because holding crypto without an ability to trade it with the same decentralized philosophy threatens the inherent value of a cryptocurrency and starts resembling a traditional asset class and its market. Unfortunately, currently, the sovereign states remain right to abolish crypto exchanges and exert control on which cryptocurrencies will be circulating; the government can also impose taxes on crypto trading and in the best case scenario apply capital gains taxes to crypto related income. (for more information about crypto regulations and taxes see our infographics).

Another benefit of DEX is advanced cybersecurity efforts. The centralization feature of centralized exchanges creates a single point of failure. Conversely, decentralized exchanges by their very nature are able to avoid such adversities, as each user practices private control over his/her assets. This way, the decentralized architecture of DEXs eradicates vulnerabilities associated with a central point of attack and reduces the theft and account hacking. Along with increased security, decentralized exchanges maximize user’s privacy by not requiring identity verification and know your customer related practices. This could be seen as one of the advantages of DEX from a user’s perspective who is looking for a higher degree of privacy, as this feature eliminates interventions, control and monitorization conducted by centralized governments and other authorities upon the accounts and account holders on the exchange platform. On another hand, exactly this feature of DEXs is highly disliked by the governmental institutions, and righteously so, as it disallows them to track or control any accounts for illegal activities such as money laundering or terrorist financing. This way, privacy properties of DEXs can be labeled as a controversial topic, as of today.

Another merit of DEX is its ability to filter out fake volumes. Trading volume inflations, practiced by market leaders has flawed traditional centralized exchange platforms for a long time. Ability to solve this problem gives DEX an edge over competitors and enables it to become a preferred trading platform due to its transparency and fairness.

Finally, DEX facilitates transactions between users by taking advantage of smart contracts(link to smart contract infographics). It is extremely important the contracts be highly protected to enforce cryptographically secure peer to peer transactions and avoid troubles orchestrated by malicious parties. With highly secure smart contracts DEX automatically becomes a secure platform for a trading execution. As some contracts might lack all appropriate security measures in place it has been proposed to launch a smart contract auditing practices, which will ensure the validity of the contract code and eliminate any loopholes that might pose threat to the transaction security and account holder’s privacy.

Issues

Along with the advantages, DEX also suffers from some drawbacks such a currently low trading volume and vague regulatory framework.

High liquidity is always desirable especially in crypto space and currently illiquid state of DEXs poses a major threat to its mass adoption. Unfortunately, traders looking for higher degrees of liquidity are pushed away to the centralized exchanges that offer more liquid trading platforms but at the same time are more expensive, with poorer security and privacy measures.

However, the traders have been willing to take on these risks because centralized platforms allow them to avoid price slippage (price variation caused due to a delay between the trade order and execution) which has been a major fear in the volatile crypto market. Some exchanges have been trying to solve a market liquidity issue by introducing stable coin — fiat backed cryptocurrencies. However, this problem can be easily solved with higher demand and bigger masses utilizing cryptocurrencies and decentralized exchanges.

Even if DEXs becomes more liquid and attractive for crypto users, regulatory compliance with different jurisdiction still poses a threat to its adoption. Thus, the unclear regulatory ecosystem of crypto has affected the decentralized exchanges too, as non-compliance with some jurisdictions make the platform less favorable over well established and legal centralized platforms. Down the road, as legislation are clarified and appropriate laws are passed, it will be easier for the crypto folks to jump on the decentralized exchanges.

Finally, the decentralized exchanges also suffer from poor user interfaces and consequently unsatisfied customers. Most of the exchanges are hard to navigate on and are also much slower in comparison with their centralized substitutes. Slower trade execution and imperfect interface further discourage users to switch to DEXs and take advantage of a trading platform without intermediaries.

Conclusion

Decentralized exchanges represent another important step towards a fully decentralized financial ecosystem. The DEXs just like crypto are in their nascent phase, which means that more exciting and disruptive things still lay ahead of us. Despite current disadvantages, as the project develops and becomes more advanced severity of these drawbacks will also fade. As of now, considering the value of such evolutionary projects that hold the capacity to entirely wipe out the centralized system behind investing, leaves us wondering what is next.

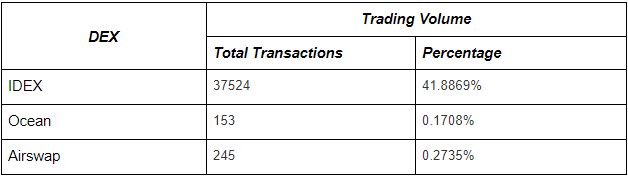

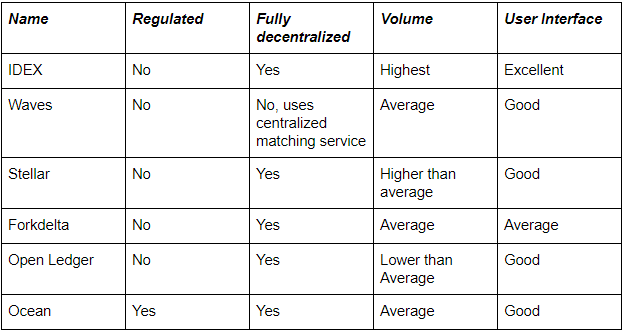

Summary Tables:

Source: Etherscan.io

Source: https://masterthecrypto.com/decentralized-exchanges-guide-popular-dex/

© Panda Analytics, Inc.

2018

比推快讯

更多 >>- 数据:298.68 枚 BTC 从 Anchorage Digital 转出,经中转后转至另一匿名地址

- 美联储 3 月维持利率不变概率达 99.1%

- 数据:470.85 枚 BTC 从 Bitstamp 转出,价值约 1267 万美元

- 贝森特:美联储距离重返量化宽松还有很长的路要走

- 美元指数上涨 0.52%,收于 99.746

- 摩根大通:自伊朗局势升级以来,避险需求转向,比特币ETF成资金新宠

- CME警告:若美国政府介入石油期货市场将引发史诗级灾难

- 特朗普:鲍威尔应立即降息而非等到下次会议

- 持有 Binance Japan 40%股份的 PayPay IPO 首日大涨 15.6%

- 伊朗称特朗普几条推文结束不了战争

- Backpack 代币上线首日后 FDV 超 3 亿美元概率为 64%

- Santiment:BNB Chain 上 USDT 活跃地址飙升通常伴随比特币反弹

- 美国参议院通过法案条款拟禁止发行 CBDC,禁令或持续至 2030 年

- Backpack 宣布将于 3 月 23 日 TGE

- Claude 上线交互式图表和图形功能,聊天中即可构建

- Ethena 调整 sUSDe 解除质押机制:冷却期改为动态模式,最短缩至 1 天

- 分析:比特币守住 7 万美元,油价飙升与信用风险冲击美国股市

- 国际油价回吐涨幅,此前伊朗副外长称允许了部分船舶通过霍尔木兹海峡

- 数据:今日加密货币市值前 100 代币涨跌

- 某鲸鱼过去 2 小时向 Hyperliquid 存入 560 万枚 USDC 做空石油

- 身份验证基础设施 VeryAI 完成 1000 万美元融资,Polychain Capital 领投

- 伊朗新任最高领袖表态强硬,油价延续涨势、美股三大股指普跌

- 投资者担心中东冲突导致通胀再度抬头,市场不再完全押注美联储今年将降息

- DNA Fund 关联钱包 2 小时前从 Kraken 提取 11,067 枚 ETH

- 油价延续涨势,WTI 原油 4 月期货日内涨超 10%

- BTC OG 内幕巨鲸代理人:油价突破,风险资产或迎剧烈重新定价

- 分析师:Circle 股价强势凸显 USDC 稳定币韧性与基础设施优势

- 交易员调整对 2026 年美联储降息预期

- Lido 整合 Earn 产品并推出首个稳定币金库 EarnUSD

- 美联储理事鲍曼:拟小幅下调大型银行资本要求

- 分析:比特币对黄金走势显现多头背离,机构流入增加暗示“风险中蕴藏机会”

- SEC 主席 Atkins 发表讲话,推动监管瘦身、支持股权代币化创新豁免

- Tether CEO:比特币链上用户 5.71 亿,USDT 约 5.5 亿

- 市场消息:特朗普政府拟暂停《琼斯法案》以平抑油价

- 美 SEC 主席:将考虑创新豁免以促进代币化证券交易

- 美 CFTC 发布预测市场咨询报告

- 美、布两油短线持续上扬,WTI 原油向上触及 96 美元/桶

- “龙虾安装热”带动相关硬件设备市场出现涨价和缺货

- 数据:PIVX 24 小时跌超 10%,CFX 涨超 7%

- 美国商品期货交易委员会发布有关预测市场的指导意见和初步规则

- 最具代表的加密托管赛道公司,Copper、BitGo 等领先

- Vitalik:以太坊本质为全球共享内存,仍需持续改进协议和基础设施

- 某巨鲸从 Binance 提出 348.3 枚 BTC,过去 9 日累计囤积 1,720.2 枚 BTC

- 伊朗伊斯兰革命卫队海军司令:将坚持关闭霍尔木兹海峡的战略

- Ark Invest:约三分之一比特币供应仍面临量子计算潜在威胁

- 伊方声明霍尔木兹海峡将维持关闭,ASTER 最大多头以 500 万规模入场做多原油

- 花旗上调油价预期:布伦特原油短期或上看 80–100 美元

- Vitalik:以太坊核心价值是全球共享“公告板”,智能合约与支付只是附加功能

- 做空 3474 万美元原油巨鲸目前浮亏 184 万美元

- 何一:散布 FUD 很容易,但清除它却总是很难

比推专栏

更多 >>- 当黄金被「困」在迪拜,是时候旗帜鲜明「唱多」香港了

- 東大、波斯、阿拉伯【第七次/進展/能源變量】|0310東3.5

- 从 HSK 到 USDGO:香港两大持牌机构,开始「脱钩」

- There is no new boss YET

- New situation and new games|0305 Asian

- B52 Were on the way to Iran|0304 Middle East

- 开放独角兽门票:从 Robinhood 到 MSX,一场 Pre-IPO 的链上平权实验

- Big player's 『Trigger moment』|0227Europe

- 简街有没有「操纵」BTC?拆解 AP 制度,读懂 ETF 申赎机制背后的定价权博弈

- Happy new year【Horse success】|0213Asian

比推 APP

比推 APP