值得信赖的区块链资讯!

值得信赖的区块链资讯!

Decentralized Exchanges (DEXs)

Decentralized exchanges are crypto exchange platforms that are open source, have no central governance and enable peer-to-peer trading, or as the name itself suggests are decentralized. DEXs ensure that a user information, such as transaction details and personal data, is safely and securely stored with a guaranteed customer anonymity.

Types

Broadly speaking, there are two types of decentralized exchanges, currency centric and currency neutral. Currency centric is more of a traditional model developed on top of an existing blockchain platform, which allows the exchange of only those currencies that are built on that very blockchain platform. Conversely, the newer model, a currency-neutral exchange enables connection between a diverse group of crypto assets that are developed on the different blockchains. This type of an exchange is constructed using a smart contract technology – Atomic Swap. This technology allows for an exchange between cryptocurrencies without a need for centralized intermediaries. Atomic swap usually happens between the blockchains of different crypto assets; however, it is possible this procedure to occur off-chain.

Benefits

An absence of central authority and established a peer to peer network are the main perks of decentralized exchanges. These features eliminate the need for a third party authenticator and the users can directly interact with each other. Further, decentralization can also result in faster and cheaper transactions if the network effect of the exchange platform increases in the long run.

Decentralized nature of DEX leads to another more significant attribute — censorship resistance. Censorship resistance ensures that no governing power can inflict restrictions and regulations on the exchange users or prohibit someone from using cryptocurrency of choice. This is a very significant aspect of DEX because holding crypto without an ability to trade it with the same decentralized philosophy threatens the inherent value of a cryptocurrency and starts resembling a traditional asset class and its market. Unfortunately, currently, the sovereign states remain right to abolish crypto exchanges and exert control on which cryptocurrencies will be circulating; the government can also impose taxes on crypto trading and in the best case scenario apply capital gains taxes to crypto related income. (for more information about crypto regulations and taxes see our infographics).

Another benefit of DEX is advanced cybersecurity efforts. The centralization feature of centralized exchanges creates a single point of failure. Conversely, decentralized exchanges by their very nature are able to avoid such adversities, as each user practices private control over his/her assets. This way, the decentralized architecture of DEXs eradicates vulnerabilities associated with a central point of attack and reduces the theft and account hacking. Along with increased security, decentralized exchanges maximize user’s privacy by not requiring identity verification and know your customer related practices. This could be seen as one of the advantages of DEX from a user’s perspective who is looking for a higher degree of privacy, as this feature eliminates interventions, control and monitorization conducted by centralized governments and other authorities upon the accounts and account holders on the exchange platform. On another hand, exactly this feature of DEXs is highly disliked by the governmental institutions, and righteously so, as it disallows them to track or control any accounts for illegal activities such as money laundering or terrorist financing. This way, privacy properties of DEXs can be labeled as a controversial topic, as of today.

Another merit of DEX is its ability to filter out fake volumes. Trading volume inflations, practiced by market leaders has flawed traditional centralized exchange platforms for a long time. Ability to solve this problem gives DEX an edge over competitors and enables it to become a preferred trading platform due to its transparency and fairness.

Finally, DEX facilitates transactions between users by taking advantage of smart contracts(link to smart contract infographics). It is extremely important the contracts be highly protected to enforce cryptographically secure peer to peer transactions and avoid troubles orchestrated by malicious parties. With highly secure smart contracts DEX automatically becomes a secure platform for a trading execution. As some contracts might lack all appropriate security measures in place it has been proposed to launch a smart contract auditing practices, which will ensure the validity of the contract code and eliminate any loopholes that might pose threat to the transaction security and account holder’s privacy.

Issues

Along with the advantages, DEX also suffers from some drawbacks such a currently low trading volume and vague regulatory framework.

High liquidity is always desirable especially in crypto space and currently illiquid state of DEXs poses a major threat to its mass adoption. Unfortunately, traders looking for higher degrees of liquidity are pushed away to the centralized exchanges that offer more liquid trading platforms but at the same time are more expensive, with poorer security and privacy measures.

However, the traders have been willing to take on these risks because centralized platforms allow them to avoid price slippage (price variation caused due to a delay between the trade order and execution) which has been a major fear in the volatile crypto market. Some exchanges have been trying to solve a market liquidity issue by introducing stable coin — fiat backed cryptocurrencies. However, this problem can be easily solved with higher demand and bigger masses utilizing cryptocurrencies and decentralized exchanges.

Even if DEXs becomes more liquid and attractive for crypto users, regulatory compliance with different jurisdiction still poses a threat to its adoption. Thus, the unclear regulatory ecosystem of crypto has affected the decentralized exchanges too, as non-compliance with some jurisdictions make the platform less favorable over well established and legal centralized platforms. Down the road, as legislation are clarified and appropriate laws are passed, it will be easier for the crypto folks to jump on the decentralized exchanges.

Finally, the decentralized exchanges also suffer from poor user interfaces and consequently unsatisfied customers. Most of the exchanges are hard to navigate on and are also much slower in comparison with their centralized substitutes. Slower trade execution and imperfect interface further discourage users to switch to DEXs and take advantage of a trading platform without intermediaries.

Conclusion

Decentralized exchanges represent another important step towards a fully decentralized financial ecosystem. The DEXs just like crypto are in their nascent phase, which means that more exciting and disruptive things still lay ahead of us. Despite current disadvantages, as the project develops and becomes more advanced severity of these drawbacks will also fade. As of now, considering the value of such evolutionary projects that hold the capacity to entirely wipe out the centralized system behind investing, leaves us wondering what is next.

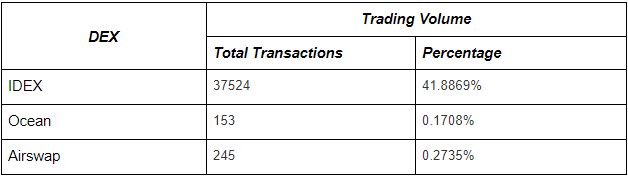

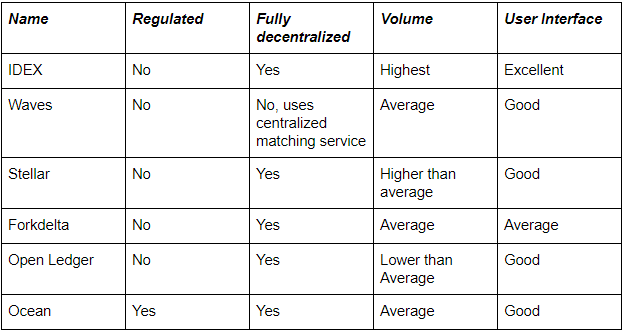

Summary Tables:

Source: Etherscan.io

Source: https://masterthecrypto.com/decentralized-exchanges-guide-popular-dex/

© Panda Analytics, Inc.

2018

比推快讯

更多 >>- 比特币完成第四次减半,挖矿奖励降至3.125 BTC

- 印度男子承认创建欺骗性 Coinbase 网站并窃取 950 万美元的加密货币

- 美联储金融稳定报告:持续通胀被视为最重要的金融稳定风险

- DAO组织Own the Doge购买与狗狗币原型Kabosu相关的图像版权

- 美国国税局公布1099报税草案,包括代币代码、钱包地址等内容

- 金融律师Scott Johnsson:年底前看不到现货以太坊ETF被批准的任何迹象

- Magic Eden:将于4月25日扩展至Base网络

- 距比特币第四次减半已不足8个小时,剩余49区块

- 半小时前Coinbase Institutional地址转出超150万枚UNI

- Coinbase:MNI-USD交易对已处于全面交易模式

- 今日9支现货比特币ETF减持472枚 BTC,价值约3044万美元

- Pyth Network推出MERL/USD价格源服务

- Coinbase Custody将于5月停止对Unifi Protocol DAO (UNFI) 和PlayDapp (PLA)的支持

- Polygon Staking地址转入4000万枚MATIC,价值超2700万美元

- UniSat:Runes上线7天内,etch和铸造可获得三倍积分奖励

- Telegram Wallet发布五项更新,支持用户直接向其 Telegram 联系人发送代币和 NFT

- 50 分钟前 Tether 向 Cumberland DRW 出售 9000 万枚 USDT

- MyShell推出基于EigenDA与Optimism的AI消费者L2网络,测试网将于下周上线

- BTC短线跌破64000美元

- 数字资产市场服务提供商Skynet Trading完成新一轮融资,Edessa Capital等参投

- 美股数字货币板块走高

- 路透社:美国债务负担恶化引发投资者关注比特币和黄金

- Lambda完成180万美元天使轮融资

- Runestone总成交额突破2500枚BTC

- HTX Ventures战略投资Merkle 3s Capital

- 贝莱德IBIT持仓超27.3万枚比特币

- 新加坡加密支付公司Triple-A新增PYUSD支持

- 美SEC:孙宇晨频繁赴美,美法院已具备相应管辖权

- 韩国监管机构推迟批准Crypto.com当地部门领导层变动

- 新加坡支付公司Triple-A 推出对PayPal稳定币的支持

- Base发布2024年第6轮Base建设者资助名单

- PADO与ArweaveAO合作发起可验证机密计算VCC

- 基于以太坊区块链的影视支付平台FilmChain完成280万欧元融资,Holt InterXion领投

- 企业忠诚度平台Superlogic完成760万美元战略轮融资,Amex Ventures等参投

- 俄罗斯国家杜马金融市场委员会主席:数字金融资产可能取代法定货币用于国际支付

比推专栏

更多 >>观点

项目

比推热门文章

- 比特币完成第四次减半,挖矿奖励降至3.125 BTC

- 【比推每日新闻精选】Michael Saylor今年通过出售MicroStrategy股票赚取3.7亿美元;金融律师Scott Johnsson:年底前看不到现货以太坊ETF被批准的任何迹象;美国国税局公布1099报税草案,包括代币代码、钱包地址等内容;美联储金融稳定报告:持续通胀被视为最重要的金融稳定风险

- 印度男子承认创建欺骗性 Coinbase 网站并窃取 950 万美元的加密货币

- 【比推每日市场动态】减半日来袭,大户再增持超12亿美元BTC

- 美联储金融稳定报告:持续通胀被视为最重要的金融稳定风险

- DAO组织Own the Doge购买与狗狗币原型Kabosu相关的图像版权

- 美国国税局公布1099报税草案,包括代币代码、钱包地址等内容

- 金融律师Scott Johnsson:年底前看不到现货以太坊ETF被批准的任何迹象

- Magic Eden:将于4月25日扩展至Base网络

- 距比特币第四次减半已不足8个小时,剩余49区块

比推 APP

比推 APP